![]()

You are applying for:

Am I eligible for this card?

Requires annual gross income

Must be 18-65 years old to qualify as Principal Cardholder

Must be 13-65 years old to qualify as Supplementary Cardholder

You are applying for:

Am I eligible for this card?

Before you start your application

![]()

Do you have an existing RCBC credit card? We encourage you to provide your 16-digit RCBC credit card number to assist on your application

![]()

Do you have an existing credit card with another bank? We encourage you to provide your 16-digit credit card number to assist on your application

Are you employed or self-employed?![]()

Gross Annual Income

I confirm that I have carefully read and understood the following:

I hereby agree and promise to abide by whatever condition as are stated therein. The absence of my written signature not withstanding, the mere submission of this application form confirms my agreement to the Declaration above stated and I hereby confirm that all matters declared in this Application are true and correct

Back to TopPrepare the following

One (1) Government ID

View Acceptable IDs

Don't have these IDs? Chat with us

A working camera on your mobile phone (For Identity Verification)

A working camera on your mobile phone

(For Identity Verification)

Your Mobile Phone (For OTP Verification)

Your Mobile Phone

(For OTP Verification)

A Valid Email Address (Your statement of account will be sent here)

A Valid Email Address

(Your statement of account will be sent here)

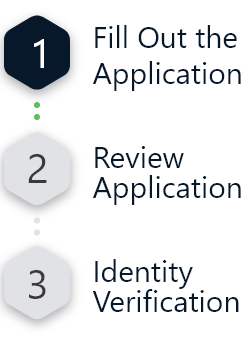

Step 1: Fill Out Application

The Middle Name must contain only letters and spaces. Numbers and special characters are not allowed.

The Last Name must contain only letters and spaces. Numbers and special characters are not allowed. Civil Status * Date of Birth * TIN/SSS/GSIS * Email Address *![]()

Mobile Number *

![]()

Home Landline Number

Country of Birth * Nationality * City of Birth *The City of Birth must contain only letters, numbers, and spaces. Special characters are not allowed.

Province of Birth *The Province of Birth must contain only letters, numbers, and spaces. Special characters are not allowed.

Municipality/City * House/Unit No., Building, Floor, Street *The House/Unit No., Building, Floor, Street must contain only letters, numbers, and spaces. Special characters are not allowed.

Subdivision/Village *The Subdivision/Village must contain only letters, numbers, and spaces. Special characters are not allowed.

Is this your permanent address * Municipality/City * House/Unit No., Building, Floor, Street *The House/Unit No., Building, Floor, Street must contain only letters, numbers, and spaces. Special characters are not allowed.

Subdivision/Village *The Subdivision/Village must contain only letters, numbers, and spaces. Special characters are not allowed.

What is your employment status? * Name of Employer *The Name of Employer must contain only letters, numbers, and spaces. Special characters are not allowed.

Nature of Work/Business * You may choose the closest option if not on the list Occupation * You may choose the closest option if not on the list Years with present employer/business (YY/MM): (e.g. 2 years and 6 months = 02/06)![]()

Work Phone Number *

Municipality/City * House/Unit No., Building, Floor, Street *The House/Unit No., Building, Floor, Street must contain only letters, numbers, and spaces. Special characters are not allowed.

Subdivision/Business District *The Subdivision/Business District must contain only letters, numbers, and spaces. Special characters are not allowed.

Preferred Delivery Address * Referrer CodeWe may call you as part of our application process. Please select the best time for you to receive our call. *

Back to TopStep 2: Review Application

Declaration of Credit Card Fees, Charges and Interest Rates. When used herein, “Card” means any credit card issued by RCBC and/or RCBC Bankard Services Corporation (the “Bank”).”Cardholder” means the person who has been issued by the Bank one or more Cards, including extension Cards.

Membership Fee. The Bank charges Membership Fee to be determined by the Bank for use of the Card and/or the other facilities and services which may from time to time be made available to the Cardholder and/or for the maintenance and administration of any balance or transaction on the Card. The Cardholder agrees to pay said fee, which may be charged to the credit line or on any available fund on the Card account.

Interest Charge. Interest will be charged if the payment made to the Credit Card by the Payment Due Date is less than the Total Balance Due, if no payment was made to the Credit Card by the Payment Due Date, or if a Cash Advance transaction has been made. The interest will be imposed at the current interest rate on the:

1.Unpaid Cash Advance balance (including interest charges and fees) from acquisition date until both the Cash Advance balance and its related charges are paid in full; and,

2.Unpaid balance (inclusive of interest charges and fees) stated in the previous statement of account and on all new transactions incurred within the previous statement period computed from the transaction date until the current statement date. No interest is charged if the Cardholder pays in full the total balance due on or before the payment due date and has no Cash Advance transaction.

Interest Computation.Interest is computed as follows:For Retail transactions: (1) Multiply the applicable monthly interest rate to Retail Transactions, installment amortizations, any retails fees and non-interest charges for the day and divide it by 30. The interest on Retail transactions and instalment amortizations in the current statement date will not be included until the next statement date. (2) Multiply the applicable monthly interest rate to previous day’s retail outstanding balance and deduct any payments made during the same day, following the application of payments, and divide it by 30. The interest computed in (1) and (2) will be the total interest for the day on Retail transactions and outstanding balance. The new retail outstanding balance will be the previous statement balance plus retail transactions, installment amortizations, retail fees and noninterest charges less payment. The retail interest for the month is the sum of the interest for each day from the day after the previous statement date to the current statement date. Interest charged on retail transactions and installment amortization will be added to the retail outstanding balance in the next statement date while interest charged on the retail fees and non-interest charges will be added to the retail outstanding balance in the current statement date.

For Cash Advance transaction: (1) Multiply the applicable monthly interest rate to Cash Advance availments and its related non-interest fees and charges for the day and divide it by 30. (2) Multiply the applicable monthly interest rate to previous day’s cash advance outstanding balance and deduct any payments made during the same day, following the application of payments, and divide it by 30. The interest computed in steps 1 and 2 will be the total interest for the day on cash advance. The cash advance outstanding balance will be the previous statement balance plus cash availments and its related non-interest fees and charges less payment. Interest charged on Cash Advances will be added to the Cash Advance outstanding balance in the current statement date.

The process is repeated until the next statement date.Monthly Installment Due Applicable to RCBC Bankard Cash Loan Installment Due, Balance Conversion Installment Due, Unli 0% Installment Due, CHARGE Installment Due, Balance Transfer Installment Due and all other Installment Due. The Monthly Installment Due forms part of the Minimum Amount Due in the Statement of Account. If the Cardholder chooses to pay only a portion of the Total Balance Due as indicated on the Statement of Account, the unpaid portion of the Installment Due shall be subject to the monthly interest charge at the prevailing rate. Usual monthly late charge applies. The computation of the Monthly Installment Due shall be on a diminishing balance basis, under which the allocation of payment to the principal and the interest of the Monthly Installment Due over the term (number of months) is not equal.

Foreign Exchange Rates. All charges and transactions made in currencies other than Philippine Pesos shall, in accordance with the Bank’s procedures, be automatically converted to Philippine Pesos at an exchange rate determined by MasterCard/Visa/JCB/China Union Pay which amount represents the Cardholder’s payment to the Bank for the purchase and payment of the foreign currency necessary to discharge the amounts due to foreign merchants. The exchange rate applied is determined on the date of posting to the Card account and may be different from the rate in effect on the date the transaction is made. The converted amount shall be charged by up to 2.03% representing the Bank’s service fee and any assessment fee(s) charged by MasterCard/Visa/JCB/China Union Pay.

Changes in Fees and Charges. The Bank reserves the right to change, at any time and from time to time, the amount, rates, types and/or basis of calculation of all interest, fees and charges payable by the Cardholder under this agreement; provided, however, that the changes shall become effective ninety (90) days from notice. The notice of changes of interest, fees and charges may be contained in the Statement of Account. The Bank may charge the new rates to the Card account and/or request that the Cardholder pay the same on demand.

Customer Undertaking and DeclarationAuthority to Verify Information. I/We hereby declare that the above information and the information in the submitted documents is true, correct, and updated; and the submitted documents are genuine and duly executed. I/We hereby authorize RCBC and/or RCBC Bankard Services Corporation to verify and investigate the information from whatever source it may consider appropriate and hereby specifically authorize RCBC and/or RCBC Bankard Services Corporation to have access to and receive information on my/our behalf from the credit bureaus, co-brand partners, government institutions, telecommunications companies and other financial institutions. I/We hereby authorize RCBC and/or RCBC Bankard Services Corporation to conduct random verification with the Bureau of Internal Revenue (BIR) in order to establish authenticity of my/our latest ITR and other financial statements submitted by me/us to RCBC and/or RCBC Bankard Services Corporation.I/We hereby declare that the above information and the information in the submitted documents is true, correct, and updated; and the submitted documents are genuine and duly executed. I/We hereby authorize RCBC and/or RCBC Bankard Services Corporation to verify and investigate the information from whatever source it may consider appropriate and hereby specifically authorize RCBC and/or RCBC Bankard Services Corporation to have access to and receive information on my/our behalf from the credit bureaus, co-brand partners, government institutions, telecommunications companies and other financial institutions. I/We hereby authorize RCBC and/or RCBC Bankard Services Corporation to conduct random verification with the Bureau of Internal Revenue (BIR) in order to establish authenticity of my/our latest ITR and other financial statements submitted by me/us to RCBC and/or RCBC Bankard Services Corporation.

Waiver of Rights on Law of Confidentiality. I/We hereby agree and authorize RCBC to collect, use, process, store, update and disclose all information, personal or otherwise, relating to me/us or my/our accounts or credit standing in relation to the use of the Card or any products, services, facilities or channels that I/we may avail of now or in the future from RCBC or any of its subsidiaries and affiliates. For this purpose, I/we hereby waive my/our rights as defined under applicable confidentiality and data privacy laws in the Philippines and other jurisdictions, including but not limited to Republic Act (RA) No. 1405 or The Law on Secrecy of Bank Deposits, RA 6426 or The Foreign Currency Deposit Act, RA 8791 of the General Banking Law and RA No. 10173 or the Data Privacy Act of 2012.

Authority to Disclose. I/We hereby give consent to the sharing, transfer, disclosure, communication and processing of any information relating to me (including information you obtain from third parties such as but not limited to any credit bureau, credit information, service providers, co-brand partners, credit and loan providers, financial institutions, telecommunications companies, other/similar information providers) from you to, between and among your branches, subsidiaries, affiliates, agents and representatives and third parties selected, such as but not limited to any credit bureau, credit information, service providers, co-brand partners in relation to the co-brand partnership (including said co-brand partner’s holding company, subsidiaries, and affiliates, and their respective shareholders, directors, employees, officers, representatives, agents and/or advisors, where applicable), credit and loan providers, financial institutions, telecommunications companies, other/similar information providers, by any of them to you (collectively referred to as the “Receiving and Disclosing Parties”), wherever situated, for use (including for use in connection with the provision of any products and services to me, and for data processing and storage, customer satisfaction surveys, product and services offers made through mail/e-mails/faxs/SMS or telephone, anti-money laundering monitoring, reporting under the Foreign Account Tax Compliance Act (FATCA), where applicable, review and reporting, statistical and risk analysis and risk management purposes). In addition to the foregoing, you or any of the Receiving and Disclosing Parties may transfer and disclose any information as may be required by any applicable law, regulation court, regulator or legal process.

Reason for Action on Application. I/We understand that RCBC and/or RCBC Bankard Services Corporation has the sole discretion to accept or reject any application. Further, RCBC/RCBC Bankard shall have no obligation to provide reason for the rejection.

I understand that I may be issued a card different from my initial preference based on RCBC and/or RCBC Bankard Services Corporation’s evaluation of my application and I agree to the issuance of a different card type.

Authority to Record and Use of Recording. By providing my telephone numbers and by calling or accepting calls from you (and your Service Providers), I authorize you to record, replay and communicate to any third party all conversations (including conversations with your Service Providers) on said phone number/line with me or any individual who may answer the phone on my behalf, being my agent. This is being done with my consent and authority. I likewise authorize you to keep a record of all forms of communication we may have coordinated, including emails, social media chats, web chats and chatbot conversations.

I authorize you to store the recorded conversations, emails, online messages through social media, web chat and chatbots conversations and agree that you may use the taped, recorded conversation, emails, or saved chat messages, with me or with any third party, in any proceeding and for any lawful purpose. You (including your Service Providers) shall not be liable for any loss, damage or expense which I may suffer as a result of your (or your Service provider) acting on such telephone communications.

I likewise understand and agree that such taped, recorded or saved conversations, emails, online messages or instructions shall be conclusive evidence of my communication with you and may be used by the latter against me or any third party for any purpose particularly as evidence in any proceeding, judicial or administrative, without incurring any liability.

Data Privacy. I acknowledge that any information collected, to be processed and retained, including updates, shall be used primarily for the facilitation and commencement of an effective administration and implementation of credit card products and services, assess my suitability for the product including but not limited to conducting all necessary background checks that may include credit scoring and investigation, data analytics and for the following purposes: